From simple solutions to most the complex projects and integrations, Maxana will help you brainstorm, design, and create new products and services. We embody the agile workplace concept and we will always assign you the optimal and best experts for any project (updated home page software development).

Transparency is key to this kind of an arrangement and we want you to have an outstanding experience and an open dialogue with us at all times. We strive to achieve best-in-class results with our clients, and you can rely on our attention to detail and critical knowledge and expertise to drive your ROI.

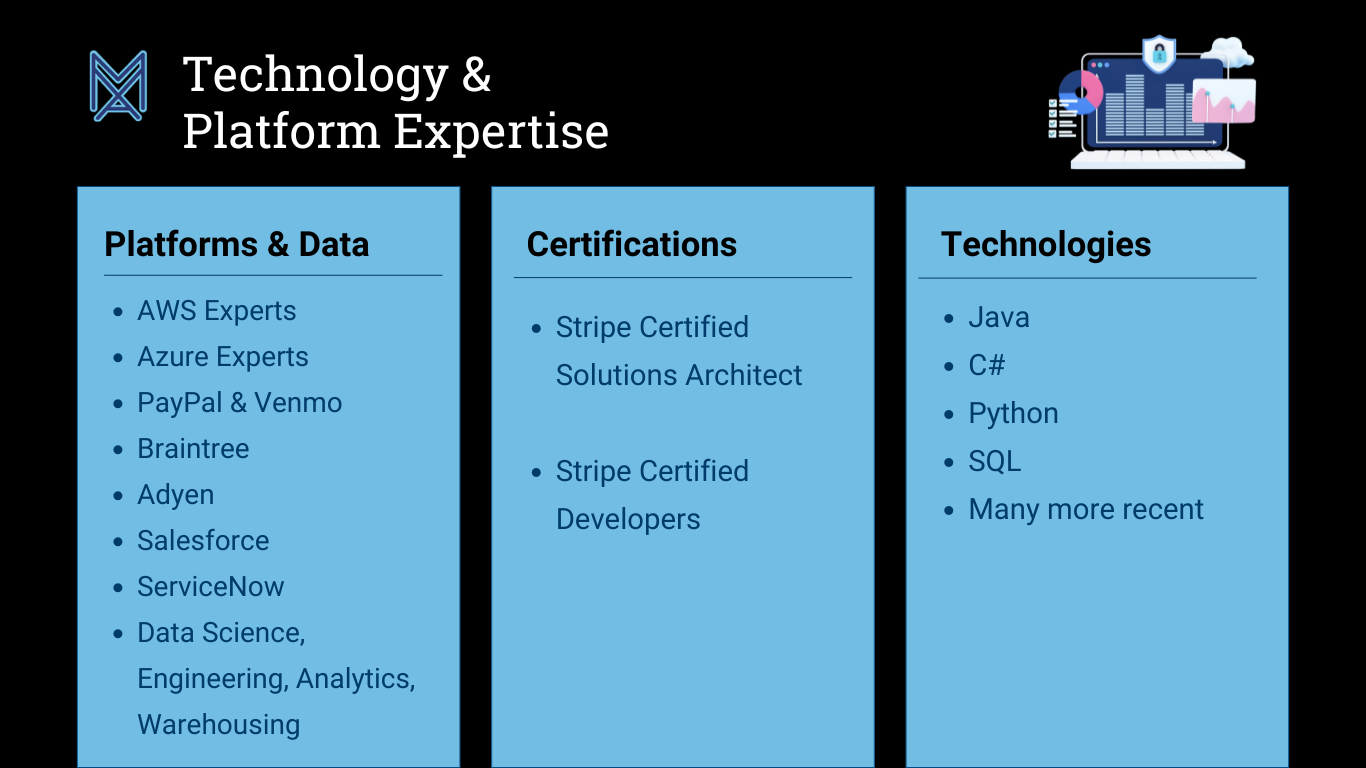

Maxana’s technology solutions will enable you to be more efficient, flexible, and competitive in the global marketplace. As the leading FinTech solutions payment company, we set the standard in delivering practical SaaS-based solutions for all your technology transaction needs.

Maxana provides tailored Cybersecurity, Machine Learning, and Artificial Intelligence solutions for federal and commercial clients. Our services ensure robust protection and innovative insights, empowering organizations to thrive in the digital age.

Click drop downs below for more information on examples

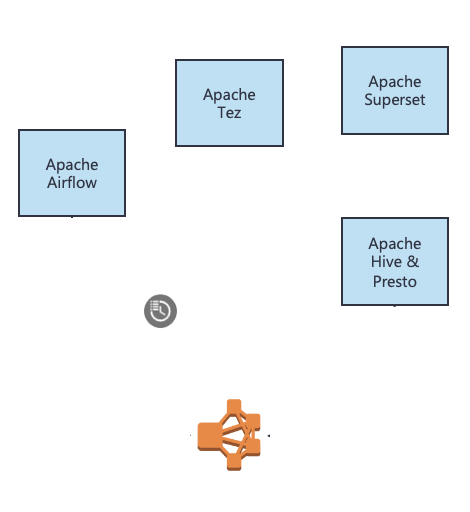

Use Case: Big Data, Geo-Diversification, and Service-Oriented Architecture Strategy

Description: Airbnb needed to migrate its application and data infrastructure from a proprietary monolithic application to a service-oriented and geo-diversified structure for customer payments. Working with Maxana, the company was able to move to microservices, and establish geo-partitioning and big-data sharding of their global databases.

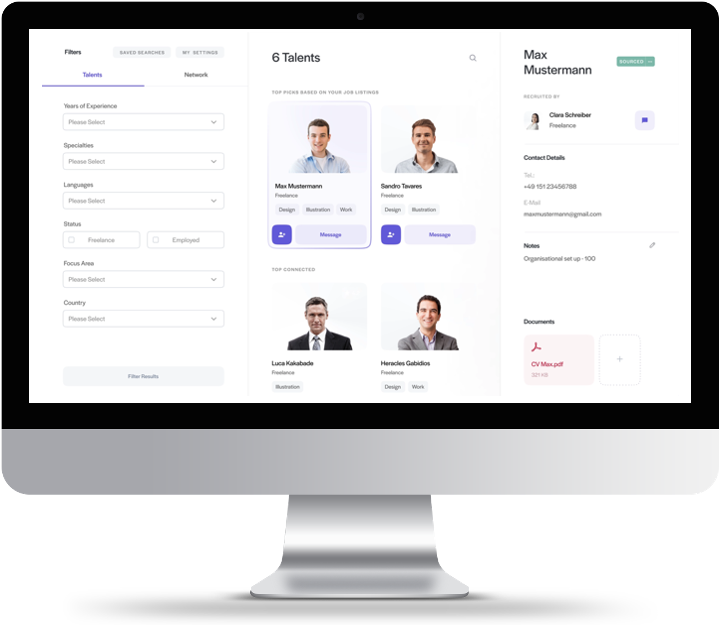

Use Case: Maxana creates white label marketplaces that enable talent firms and providers a proprietary marketplace that is agnostic to any choice of payments platform.

Description: Maxana is building a proprietary white label marketplace that can be leveraged for technology, healthcare, and temporary staff across multitude of business use cases and vertical markets.

Use case: Payment Risk Intelligence Platform

Description: Airbnb was looking to build a proprietary payments intelligence platform. The client in collaboration with Maxana’s data science and engineering team is working to build a unified system that consolidates risk, compliance and investigative tooling providing a single lens of all payment transactions for fraud and compliance-based investigations.

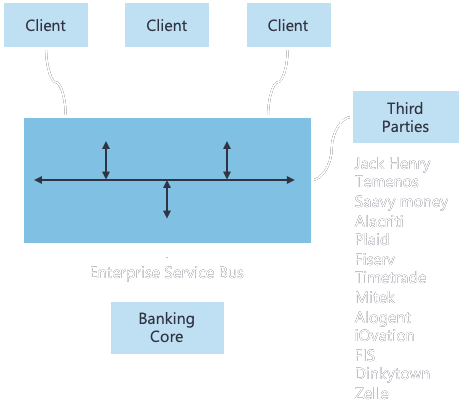

Use Case: Digital Banking Transformation vertically integrated omni channel experience.

Description: A Financial Services company based in Silicon Valley was faced with an aging portfolio of archaic online and mobile banking platforms. Maxana provided strategic program support evaluating seven major banking platform vendors, performed Total Cost of Ownership, facilitated RFP and vendor selection, and analyzed 30 major third-party integrations including payment platform, Zelle.

Use Case: New Digital Account Opening system leveraging latest commercial technology platforms.

Description: A Financial Services company based in Silicon Valley wanted to expand and improve their ability to onboard new customers as part of their Digital Transformation strategy. Leveraging Temenos’ Avoka platform the Maxana team worked with the client and vendors to deploy the solution which transformed the User experience and streamlined new customer onboarding. Third party integrations included Alacriti, Plaid, FIS, Mitek, and iOvation.

Fintech is the collection of programs, apps, and other data associated with banking, investing, and lending. The idea is to develop and use new methods of doing business. Companies will automate mundane portions of the business model. An online payment system is a good example of such a mundane operation. Letting your customers pay automatically through your payment gateway, whether with credit cards or debit cards, is convenient for them. If you can remove a point of pain, such as waiting on hold for a rep, then you will not only improve the customer experience, but you will also give them something to talk about favorably with their friends and family. That’s the network effect in action again.

As the premier FinTech payments company, we are also experts in secure payments, AI, blockchain, and cloud-based solutions. Coupled with our focus on big data, we’ll be able to help you analyze existing trends, forecast new ones, and design not only payment processing software but also security protocols to help you protect your network and your critical assets.With Maxana’s payments solutions, you won’t need anything else. We integrate leading payments technology to help with all transactions, including credit cards, ACH, Stripe, PayPal, Venmo, and multiple other payment methods.